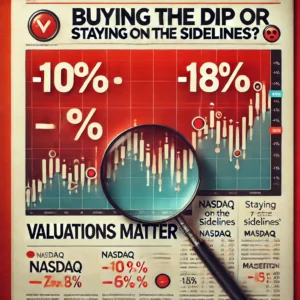

The financial markets have recently encountered significant turbulence, with the NASDAQ index dropping over 10% from its peak earlier this year. This decline has been especially steep among the group of prominent technology stocks often referred to as the “Magnificent 7,” which have fallen more than 18% from their highs in early February. While some attribute this downturn to external factors like potential tariffs, a deeper analysis suggests that market valuations and investor sentiment play a more substantial role.

Principle-Driven Investing

In times of market volatility, adopting a disciplined and principle-driven approach to investing becomes essential. This strategy rests on several core tenets:

- Present Value of Future Cash Flows: The true worth of any investment lies in the present value of its anticipated future cash flows. This principle emphasizes evaluating a company’s long-term ability to generate cash.

- Understanding the Business: Investments should only be made in companies that an investor fully comprehends. This understanding helps ensure decisions are rooted in knowledge rather than guesswork.

- Price Matters: A promising business can become a poor investment if purchased at an inflated price. Securing assets at a reasonable cost with a margin of safety is critical.

- Short-Term vs. Long-Term Perspectives: In the short term, stock prices may fluctuate due to market sentiment, resembling a “voting machine.” Over the long term, however, they align with a company’s fundamental value, acting as a “weighing machine.”

The Adobe Example

A compelling case study is Adobe Inc., a leader in software products and services. Recently, Adobe announced quarterly results that exceeded expectations, posting earnings per share of $5.58 against a forecast of $4.97 and revenue of $5.71 billion compared to an anticipated $5.66 billion. Surprisingly, its stock price plummeted by about 13.5% in a single day.

This drop likely reflects broader market negativity rather than a flaw in Adobe’s fundamentals. Concerns have arisen about the potential impact of artificial intelligence on Adobe’s business model. Yet, Adobe’s track record of innovation suggests it can adapt and leverage AI to enhance its offerings. Currently trading at a discount to its historical valuations, Adobe may represent an attractive opportunity for investors focused on its long-term potential.

By using conservative growth estimates and assessing Adobe’s capacity to produce future cash flows, one might conclude that its current price offers a reasonable entry point. This approach exemplifies how principle-driven investing can uncover value amid market overreactions.

Market Fluctuations and Investor Mindset

Market downturns, though challenging, can be advantageous for prepared investors. The ability to stay calm and see falling prices as buying opportunities is a key trait of successful investing. When evaluating a stock, consider these questions: Will the company remain viable and grow over the next few decades? Does the current price provide a sufficient return based on realistic future projections? If the answers are affirmative, a price drop can signal a chance to invest rather than a cause for alarm.

Selling Cash-Secured Puts

One practical strategy during volatile periods is selling cash-secured puts. This involves agreeing to buy a stock at a set price (the strike price) by a specific date, in return for a premium. If the stock price stays above the strike price, the investor keeps the premium without purchasing the shares. If it falls below, the investor buys the stock at the agreed price, effectively securing it at a discount thanks to the premium received.

For example, imagine an investor eyeing a company trading at $400 per share but hesitant to buy at that level. They could sell a cash-secured put with a $350 strike price, expiring in one month, for a $5.25 per share premium, earning $525 (as each option typically covers 100 shares). If the stock remains above $350 at expiration, the investor retains the $525. If it drops below $350, they purchase the shares at $350, but the premium lowers their effective cost. This method allows investors to generate income while targeting desired stock prices.

Conclusion

The current market environment highlights the importance of a steadfast, principle-driven investment strategy. By prioritizing fundamental analysis, embracing a long-term outlook, and seizing opportunities presented by volatility, investors can navigate uncertain times and foster sustainable growth. Whether through direct stock investments or tactical options strategies, staying anchored in sound principles enables one to view market swings as prospects for advancement rather than setbacks.