U.S. Equity Market Concentration: Are We Entering Overvaluation Territory?

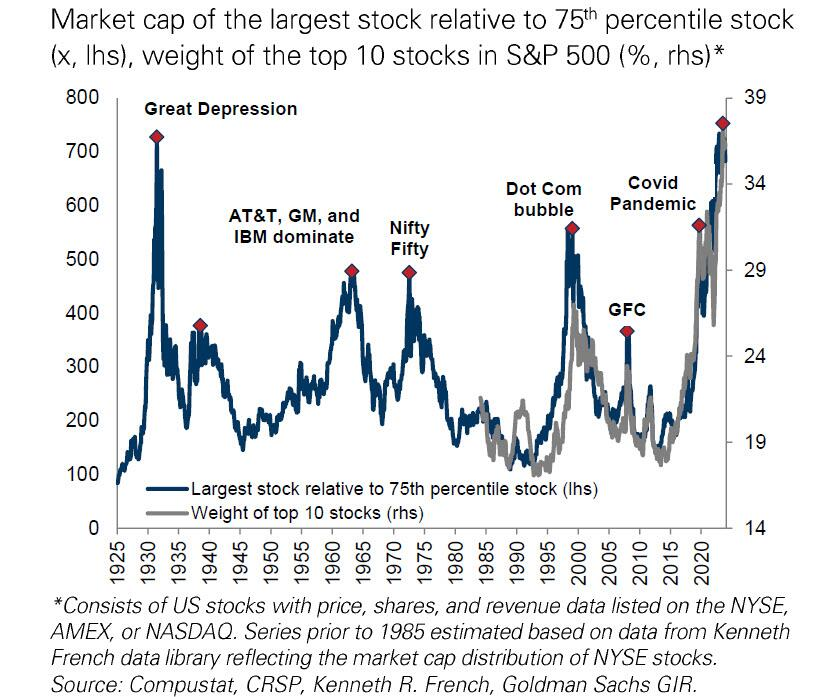

A recent chart from Goldman Sachs highlights a striking trend in U.S. equity markets: the market cap of the top 10 stocks in the S&P 500 now accounts for 38% of total market capitalization. The last time market concentration was this high was during the Great Depression, raising concerns about potential overvaluation and systemic risks.

This trend isn’t new—market concentration has surged during various periods, such as the Nifty Fifty era, the Dot Com bubble, and more recently, during the Covid-19 pandemic recovery. Each time, heightened concentration coincided with speculative fervor and, eventually, significant market corrections. Given this historical pattern, it’s worth asking: Are we on the brink of another overvaluation-driven correction?

Why High Market Concentration Signals Risk

Market concentration occurs when a small number of large companies dominate the stock market. While these companies may be industry leaders with robust fundamentals, excessive concentration can skew overall market valuations and create instability. Here’s why:

- Skewed Valuation Metrics

When a handful of companies dominate the market, their high valuations inflate overall index metrics like the Price-to-Earnings (P/E) ratio. This creates an illusion of market strength, even if most other stocks aren’t performing well. - Systemic Vulnerability

With such a large share of the market tied to a few companies, any negative news affecting these firms can trigger outsized market reactions. A correction in one or two major players could lead to a domino effect, dragging down the broader market. - Past Precedents of Bubble Bursts

History provides several cautionary tales. In the late 1920s, leading up to the Great Depression, market concentration was similarly high. The Dot Com bubble in the late 1990s also saw tech giants dominating the market before crashing. Each period of excessive concentration ended with a significant downturn.

Signs of Potential Overvaluation in 2025

Let’s examine some key indicators suggesting that current market levels may be overvalued:

- Stock Market to GDP Ratio

Historically, the stock market’s total capitalization relative to GDP (commonly referred to as the “Buffett Indicator”) has averaged around 100%. As of now, it stands significantly higher, signaling potential overvaluation. - Cyclically Adjusted P/E (CAPE) Ratio

The CAPE ratio, which adjusts earnings for inflation and averages them over a 10-year period, is well above its historical average, indicating that stocks may be overpriced relative to their long-term earning potential. - Investor Sentiment and Speculative Behavior

Similar to previous bubbles, speculative enthusiasm is back, with investors pouring money into trending sectors like artificial intelligence and other high-growth industries. When markets are driven more by hype than fundamentals, the risk of a correction rises.

How to Navigate an Overvalued Market

For investors, navigating a potentially overvalued market requires a disciplined approach:

- Diversify Beyond Mega-Caps

While the largest stocks may be tempting, over-reliance on a few dominant players can expose your portfolio to undue risk. Consider diversifying into mid-cap and small-cap stocks, as well as international markets. - Focus on Valuation and Fundamentals

Stick to value-driven investing principles. Look for companies with solid balance sheets, consistent cash flows, and reasonable valuations relative to their earnings. - Prepare for Market Volatility

With heightened concentration comes the risk of increased volatility. Investors should be prepared for sharp market swings and have a strategy in place to handle potential downturns. - Dollar-Cost Averaging

Rather than trying to time the market, dollar-cost averaging allows you to invest consistently over time, reducing the risk of entering at market peaks.

Conclusion: Stay Vigilant, Stay Disciplined

High market concentration, historically high valuations, and speculative behavior are all flashing warning signs for the U.S. equity market. While no one can predict the exact timing of a correction, the current environment warrants caution.

Investors should focus on long-term strategies, diversify their portfolios, and avoid getting caught up in speculative hype. As history has shown, periods of high market concentration often precede significant corrections. Staying disciplined and adhering to sound investment principles will help you navigate any market environment with confidence.

Interested in learning more about value-driven investing and building wealth through smart strategies? Join UP-Education today and train your brain to invest for long-term success!

Disclaimer: Up-Education is not a financial advisor. All information provided is for educational purposes only. Always consult with a certified financial professional before making any investment decisions. The views expressed here are solely our own and should not be interpreted as financial advice or a recommendation to make any specific investment decisions. Use this information at your own discretion and responsibility.